A broader investment spectrum for tailored strategic and financial support.

Gaia Impact, through its new fund GEIF II, defines itself as a long-term partner actively involved in the development of the companies in which it invests. GEIF II is designed to meet financing needs in the seed phase, but also to be present alongside more mature companies.

The increase in the size of investment tickets, in comparison with the first fund, will enable Gaia Impact to broaden its scope of action, diversify its risk and maximize its environmental and social impact by remaining the financial and strategic partner of the entrepreneurs it supports and accompanies along the decentralized renewable energy value chain.

Gaia Impact is positioned among VC funds as a long-standing equity provider, with expertise in the distributed energy sector and in developing geographies. Gaia Impact’s understanding of each entrepreneur’s specific environment and needs enables its team of experts to provide the tools needed to deploy sustainable, affordable, efficient and human capital-centered solutions.

GAIA ENERGY IMPACT FUND II ⸻

Investment Strategy

500 K€ to 5 M€

INVESTMENT FROM

Series Seed to Series B

TARGET

85%

INVESTMENT IN SUB-SAHARAN AFRICA

Ex-ante impact targets

4 000 000

PEOPLE WILL HAVE A BETTER ACCESS TO ENERGY

20 000

JOBS CREATED AND SUPPORTED

4 000 000

TONNES OF CO2 AVOIDED

Mini grids

Electrification solutions for communities and villages (“mini grids”).

Decentralized systems

Solar home systems (SHS) for individuals and small businesses.

Commercial & Industrial

Solar energy production and storage infrastructures for SMEs (C&I).

Productive uses

The kWh produced enable innovative use cases: e-mobility, solar pumping for irrigation, cooling solutions…

Enabling technologies

Technical innovations (IoT, software, equipment, etc.) enabling energy operators to optimize costs, thereby reducing the cost of access for users.

New renewable energies

Hydrogen, waste-to-energy solutions…

Hélène Demaegdt

President & Founder

« La finance à impact est une stratégie d'investissement qui vise à accélérer la transformation juste et durable de l'économie réelle. C’est précisément parce que nous sommes conscients des enjeux climatiques et préoccupés par les inégalités au niveau global, que nous agissons en investissant pour la Transition Juste. Cette démarche ne contribue pas seulement à faire progresser l’action climatique mais permet également de progresser dans la réalisation de tous les objectifs de développement durable (ODD), notamment ceux relatifs à l’énergie propre et à un coût abordable, à la croissance économique et à la réduction des inégalités. »

GAIA IMPACT ⸻

IMPACT

Screening

Checks on company reputation and compliance with exclusion list

Preliminary assessment

Characterization of the company’s contribution to the 3 general impact objectives

Due diligence

Environmental, social and governance due diligence using our ESG audit tool

Investment Decision

Compliance checks with Gaia’s ESG policy and implementation of a monitoring system and ESG action plan

Monitoring

Monitoring of 2X challenge indicators, general and specific impact indicators, PAI indicators and ad hoc indicators relating to compliance with ESG action plan

Screening

Preliminary assessment

Due diligence

Investment Decision

Monitoring

Checks on company reputation and compliance with exclusion list

Characterization of the company’s contribution to the 3 general impact objectives

Environmental, social and governance due diligence using our ESG audit tool

Compliance checks with Gaia’s ESG policy and implementation of a monitoring system and ESG action plan

Monitoring of 2X challenge indicators, general and specific impact indicators, PAI indicators and ad hoc indicators relating to compliance with ESG action plan

Understanding how we create impact

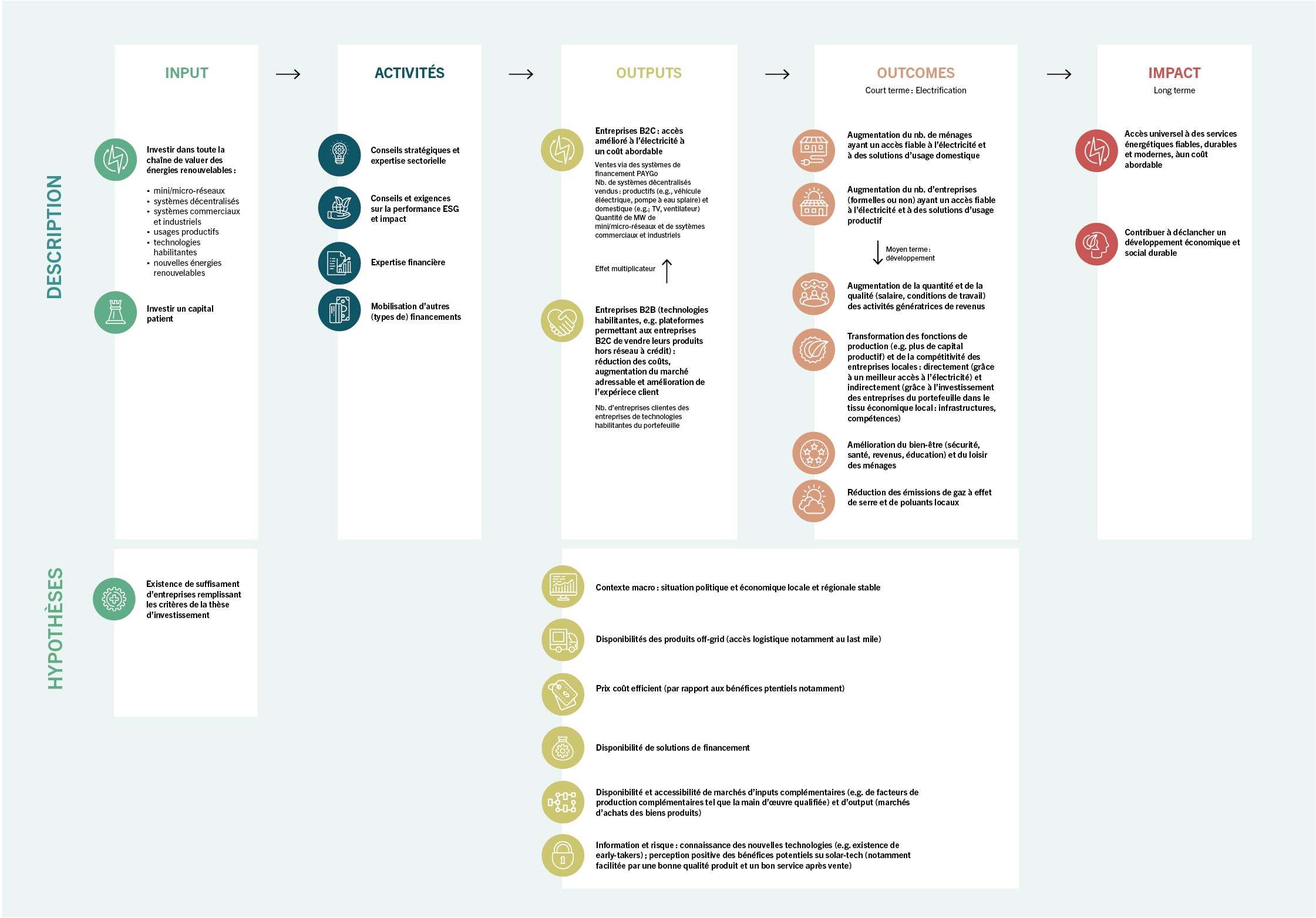

The first building block in our approach is the definition of a Theory of Change (TOC) for GEIF, based on our experience as an impact investor, but also on lessons learned from the sector as a whole and from academic literature. This TOC is central to our approach, enabling us to:

- Link our activity as an impact investor to the social, economic and environmental changes we wish to promote.

- Identify the indicators over which we (or our portfolio companies) have direct control, and which contribute to achieving our short-, medium- and long-term impact objectives.

- Identify the critical conditions necessary for our inputs and activities to trigger the desired impacts.

- Define our impact thesis.

Measuring our impact

The second pillar of our approach, in conjunction with the TOC, consists of estimating two types of impact indicators: general indicators and specific indicators.

General indicators allow to measure the contribution of each investment to the fund’s overall impact objectives. Specific indicators reflect the specific impact of each investment, which is not reflected by the general indicators (e.g., increased productivity for an investment in a company marketing solar water pumps); wherever possible, they are derived from the UN’s Sustainable Development Goals. The calculation methodology and the achievement of objectives, as well as the choice of specific indicators, are validated by the fund’s Impact Committee.

Maximizing our creation of social well-being

The third pillar of our approach is to measure the efficiency of our investments. To establish an objective measure, we are developing a cost-benefit analysis (CBA) tool, in partnership with the Paris School of Economics, through the funding of a thesis.

CBA is a scientifically robust quantitative evaluation methodology used by financial backers to determine the collective utility generated by an investment. It can be used to rank different investment options in terms of their socio-economic profitability.

CBA has three distinctive features:

- It is an incremental analysis: the costs and benefits generated by the investment are compared with the costs and benefits that would have occurred in the absence of the investment.

- All costs and benefits are monetized: in order to be able to compare all the costs and benefits of the investment, which are different in nature (environmental, social, economic and financial), these costs and benefits are transformed into a common unit, the monetary unit.

- The analysis is carried out over the long term: all costs and benefits are estimated over the life of the project, and reduced to a present-day value using a socio-economic discount rate. Two types of indicators can then be estimated:

– The Socio-Economic Net Present Value (SE-NPV) indicates the social welfare creation, net of costs, of the project over its entire lifetime:

– The socio-economic Return on Investment (ROI-SE) indicates the creation of social well-being for each euro invested.

Understanding sustainability risks

In addition to measuring our impact, we also take ESG factors into consideration. These factors are measured by activity indicators: they measure our performance in absolute terms, and not against a counterfactual.

These indicators are measured during the due diligence phase (ESG performance is assessed using our ESG due diligence tool (DD ESG)) and through annual reporting of PAIs, as defined by the SFDR. In addition, all companies in the portfolio are committed to a plan to improve their social, environmental and governance practices.

Understanding sustainability risks

To ensure the robustness and relevance of its impact measurement methodology, GEIF has set up an Impact Committee. This independent committee is made up of non-executive profiles (entrepreneurs, researchers, industry experts). Its mission is to validate whether or not the general and specific objectives have been reached, and if so, to trigger the impact carried.